Video: Share Trading

This short guide will help you to understand how the Share Trading platform works.

The Share Trading platform

This event is run by Healthy Co to facilitate the repurchase of shares by the company from existing shareholders. The repurchase price is fixed and will be applied to all sell orders.

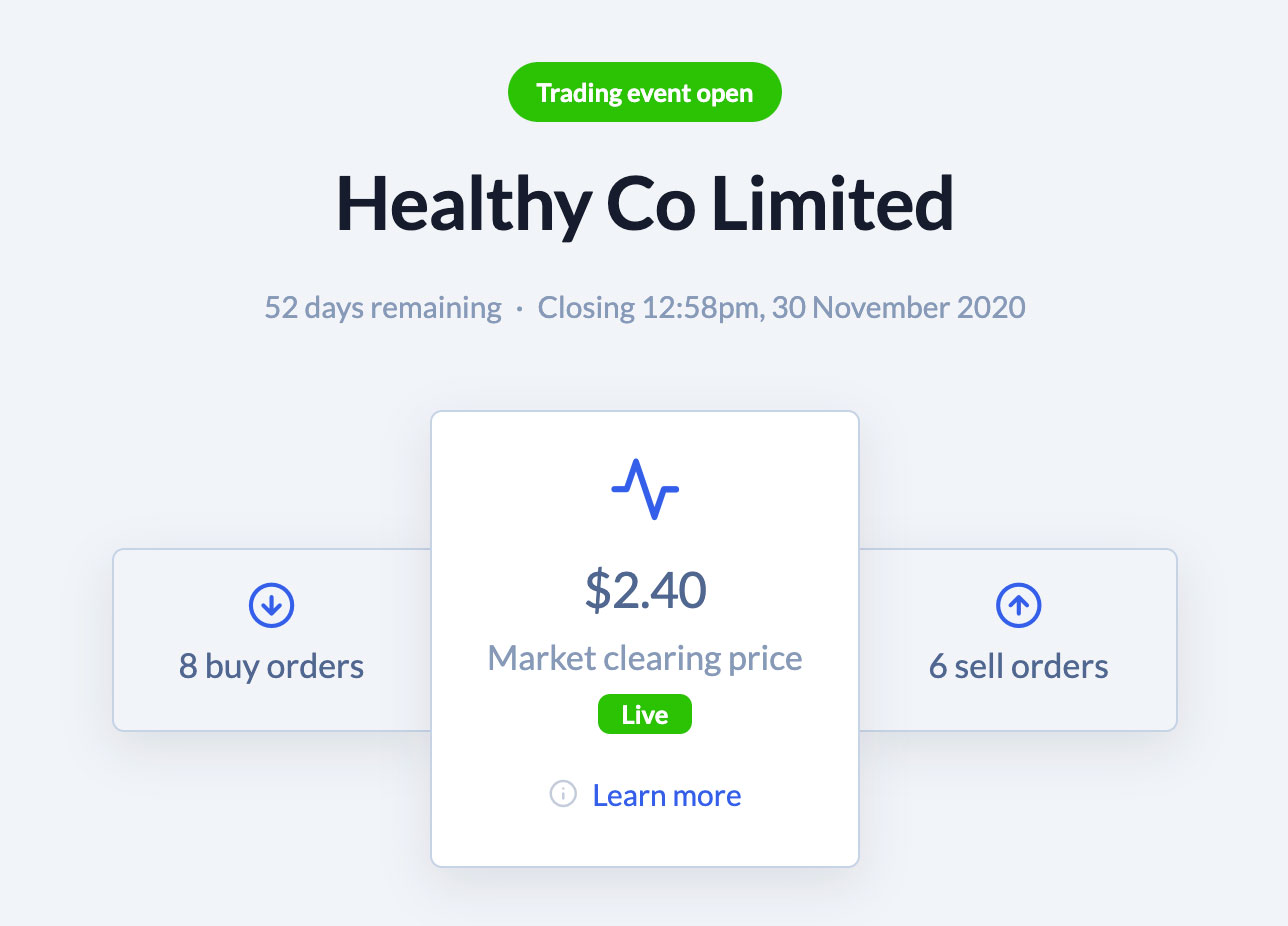

Healthy Co Limited will make the Service available for a set number of days, referred to as the Trading Event. The Trading Event will be open from the time the Company declares it open until the time it designates that it is closed.

Once the Trading Event has ended, Snowball Effect will facilitate the closing process which includes identity checks, transfer of funds and cancellation of the repurchased shares.

Video guides

The Share Trading process

Trading event is open to shareholders

Once the trading event has opened, sellers will be able to view the trading report and the current status of the trading event.

Place your sell order

Place your sell order, indicating the number of shares in your order.

End of the trading event

Once the trading event closes, we will transfer funds to the selling shareholders.

Transfer of shares

Once all paperwork and funds transfers have been completed, the repurchased shares will be cancelled, and the share registry will be updated.

Market Clearing Price

The company is making a fixed price offer to repurchase. All sell orders will be cleared at this fixed price.